WHAT IS IT?

The most common example of a car fringe benefit is where an employer owns or leases a vehicle which is then provided to an employee to use for privately or for non business purposes.

The Car is available for private use by an employee when:

- It is used by the employee or an associate for non business related travel

- The vehicle is not stored on the business premises and the employee is permitted to use it for private purposes

- The vehicle is store at the employees residence

If you run your business through a company or trust you may be considered to be an employee of the entity and a car fringe benefit may arise.

CALCULATING THE

TAXABLE VALUE

There are two methods for calculating the taxable value of a fringe benefit; the statutory formula method or the operating cost method.

STATUTORY FORMULA METHOD

In order to determine the taxable value the base value of the car at the purchase date or lease date is multiplied by a statutory percentage. The number of days the vehicle was not available for private use will reduce your liability. Similarly any employee contributions received to cover the costs of the vehicle will reduce the liability payable.

Under the operating cost method the taxable value is based on the portion of total costs of owning or leasing the vehicle which relate to private use during the FBT year.

Operating costs; repairs, maintenance, fuel, registration and insurance. Also included in operating costs are deemed cost such as interest and depreciation.

Where the vehicle is under a lease, the leasing costs for the period it’s used to provide fringe benefits are also included in the operating cost.

Logbooks; in order to calculate the business use percentage a log book must be maintained. This is done over a 12 week period to represent the business use for the full FBT year.

An employer can use the operating cost method for a year where a log book hasn’t been maintained, there is no reduction in the operating cost of the car for any business journeys made.

Private use. Generally, any use of the car that is not for income-producing purposes such as travel to and from work is normally private use, even where the employee undertakes minor errands like collecting the mail.

Employee reimbursement. Any unreimbursed car expenses incurred, or contribution made by the employee can reduce the taxable value of a car fringe benefit under the operating cost method, as illustrated.

EXEMPT CAR BENEFITS

Base Value; This is the original cost price of the vehicle. Where the vehicle has been owned for more than 4 years the base value will be reduced by 2/3.

Cost price; Original purchase cost of the vehicle, including GST and luxury car tax. This amount does not include stamp duty, registration, or delivery and any non-business accessories (paint, fabric and rust protection or window tinting).

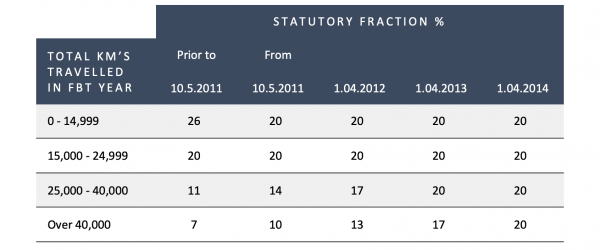

Statutory Percentage; where a vehicle was purchased after 10 May 2011, a flat rate of 20% applied regardless of how many km’s were travelled in the FBT year. Where there was a pre existing commitment to purchase the vehicle before 10 May 2011 the following table outlines the applicable statutory percentages.

OPERATING COST METHOD

WORK RELATED TRAVEL IN

COMMERCIAL CARS

Where a vehicle is a taxi, panel van, utility or other road vehicle designed to carry a load, other than passengers of less than one tonne, and the employee’s private use is limited to incidental or minor work-related travel such as between home and work that is infrequent and irregular, these car benefit provided will be exempt from FBT.

EMERGENCY SERVICE VEHICLES

Vehicles used for emergency services are exempt car benefits where they are one of the following;

- Police Vehicles

- Ambulance

- Fire fighting service vehicle

- Fitted with flashing lights and a siren

- Has exterior markings which indicate its use

CARS SUPPLIED BY PERSONAL ENTITIES

If you operate your business through a personal service entity you will only be able to claim deduction for one vehicle. The expenses which relate to any other vehicles owned by the entity will be exempt in relation to FBT.

This article is provided as general information only and does not consider your specific situation, objectives or needs. It does not represent accounting advice upon which any person may act. Implementation and suitability requires a detailed analysis of your specific circumstances.