Obtain professional advice before selling your business

For most small to medium sized business owners, the value of their business is often their biggest asset and the main source of their retirement fund.

In order to receive the maximum net proceeds in the event of selling your business, it is important to consider the Capital Gain Tax implication and understand your eligibility for available concessions. Many taxpayers failed to utilise those concessions due to poor transactions planning and having assets held in inappropriate structures. It’s worth noting that being a small business owner does not mean you are automatically eligible for all available CGT concessions.

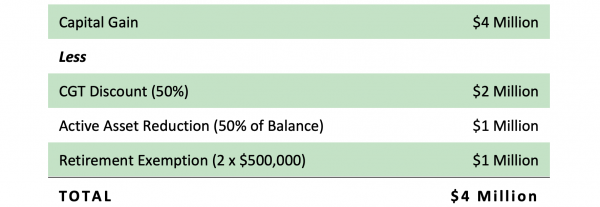

Although the rules are complex, with the correct planning in place, a husband and wife can receive as much as $4 million tax free after the sale of their business. (Better still, if you have operated your business for 15 years or longer, the entire sale proceeds might be tax-free!)

KEY CONSIDERATIONS

- Companies are NOT eligible for the 50% CGT general discount

- Period of business/asset ownership must exceed 12 months – 50% CGT general discount

- Taxpayer group (includes connected & affiliated entities)

- Must be under $6M in net value; or

- Under $2M turnover threshold

- Further 50% CGT discount for ‘active assets’ used in the business for a certain period

- To maximise the concessions, the business owner(s) might need to use the ‘retirement exemption’, rolling up to $500,000 per individual of their sale proceeds into superannuation

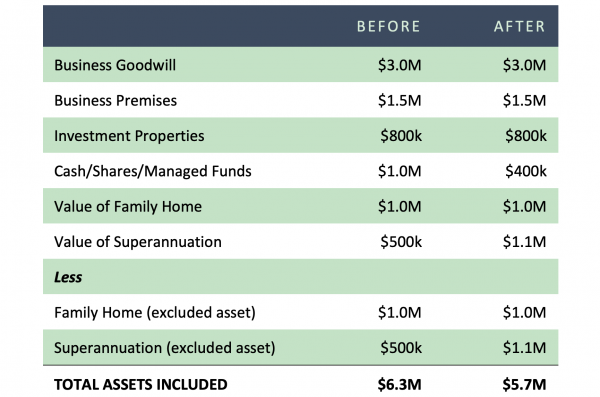

As illustrated above, the total assets values included in the total asset value test is brought down to $5.7M by converting $600,000 of liquid assets (cash/shares) and making a non-concessional contribution to super fund. As a result, the small business CGT concessions can now be applied.

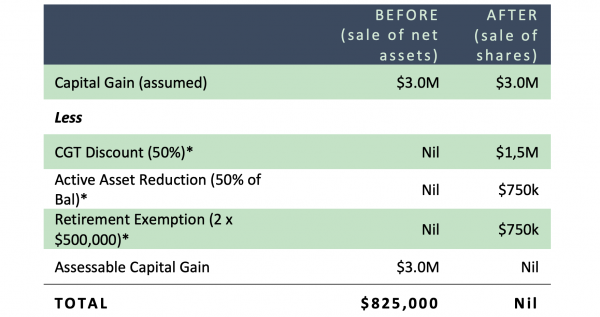

So, after executing the above simple strategy what result can we achieve after sale of business:

ULTIMATE CGT POSITION

Effective planning for the sale of your business can make a huge difference to your after-tax return – up to $4M

HERE IS AN EXAMPLE

A client advised us they plan to sell their business in 2 years. The business was run in a company structure and we were able to implement a strategy to help them obtain the maximum net proceed. Below is a comparison showing the results before and after implementing the strategy, with the assumption the business was sold by sale of net assets in the “Before” scenario and by sale of shares in the “After” scenario.

* Without proper advice, the business was unable to meet the conditions to access small business CGT concessions – as such, the entire capital gain has become taxable in the hands of the company.

Without professional advice, such an “After” results may not be achieved. There are two common explanations why business owners often miss these generous tax concessions, these being:

- Timing – you leave it too late to seek expert advice about your plan to sell; or

- Expertise – your advisors lack understanding of the legislation and restructuring opportunities

As taxation specialists, our focus is on helping you obtain access to these concessions and maximising the net proceeds available to you.

SELLING YOUR BUSINESS FOR MAXIMUM NET WORTH

There is a high chance you will miss out on the generous small business CGT concessions if you do not have proper pre-sale planning. Poor Planning in this area could mean a potential loss of $1 million in legitimate tax concessions. As shown in the previous example, if you operate out a company structure and sell your business by disposing of the net assets, you will not be eligible for the 50% CGT general discount.

Timing is imperative, almost all restructure opportunities are lost once you have signed a contract, even super contributions made post contract date are invalid when looking at the $6M net asset test.