FEDERAL BUDGET 2019 NEWS

Federal Budget 2019

The Treasurer Josh Frydenberg’s first budget has lots of goodies with few “baddies”. This was to be expected with the next federal election only weeks away and the Coalition Government trying to make up ground in the polls.

The Treasurer’s “wow” factor was a return to a budget surplus of $7.1 billion for the 2019-20 fiscal year.

Without increasing taxes, the Coalition Government, if re-elected, promises to deliver on a mix of benefits for a majority of taxpayers in Australia. These include:

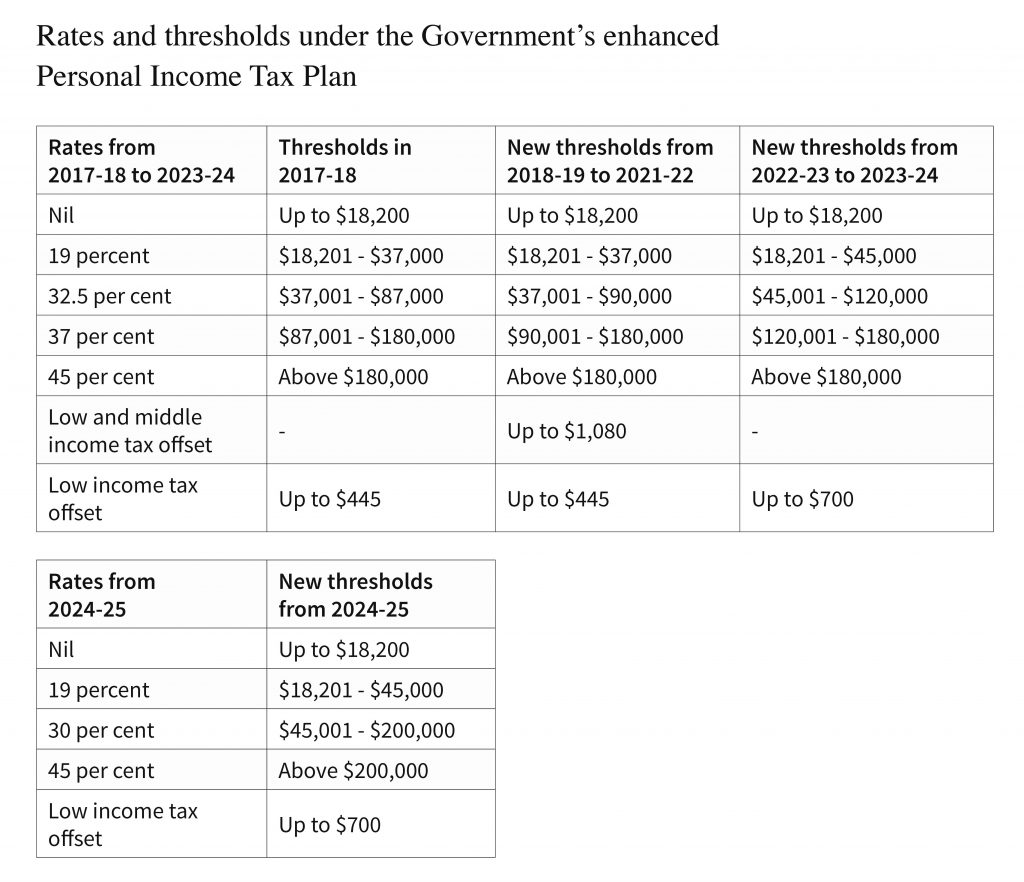

- Personal income tax cuts through adjusting upwards the thresholds at which the current tax rates apply (from 1 July 2022 to 30 June 2024) and then, finally, in the income year ending 30 June 2025, having only three rates of tax, with the highest marginal rate (45%) commencing at $200,000.

- Increasing the Low and middle income tax offset to a maximum offset of $1,080 for the years ending 30 June 2019, 2020, 2021 and 2022.

- Increasing the instant asset write-off threshold from $25,000 to $30,000 and extending this so that businesses with a turnover of between $50 million and $10 million can also access the concession. This will apply from Budget night until 30 June 2020.

Apart from the above, the budget was quite “light” on tax and superannuation changes. The government, no doubt, is trying to make itself a small target in relation to the coming election.

Also note that proposed changes to Division 7A will be deferred from 1 July 2019 to 1 July 2020, and that there are some useful changes to superannuation that will benefit older pre-retirees.

INDIVIDUALS

Individual tax relief via increased LMITO

The previously proposed (and legislated) low and middle income tax offset (LMITO) will now be increased from a maximum amount of $530 to $1,080 a year for singles and the base amount will increase from $200 to $255 a year for the 2018-19, 2019-20, 2020-21 and 2021-22 income years.

As a result, the LMITO will now provide a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. For taxable incomes between $37,000 and $48,000, the value of the offset will increase at a rate of 7.5 cents per dollar to the maximum offset of $1,080.

As a result, taxpayers with taxable incomes between $48,000 and $90,000 will be eligible for the maximum offset of $1,080. For taxable incomes between $90,000 to $126,000 the offset will phase out at a rate of 3 cents per dollar.

The LMITO will be received on assessment after individuals lodge their tax returns for the relevant income years.

Future changes in tax thresholds and rates

Reductions in individual thresholds and/or marginal tax rates will apply in future income years. From 1 July 2022, the top threshold of the 19% personal income tax bracket will be increased from the previously legislated $41,000 to $45,000.

From 1 July 2022, the government will increase the low income tax offset (LITO) from $645 to $700. The increased LITO will be withdrawn at a rate of 5 cents per dollar between taxable incomes of $37,500 and $45,000, instead of at 6.5 cents per dollar between taxable incomes of $37,000 and $41,000 (as previously legislated).

LITO will then be withdrawn at a rate of 1.5 cents per dollar between taxable incomes of $45,000 and $66,667. (Note that following these changes the proposed LMITO relief will be removed.)

From 1 July 2024-25, the 32.5% marginal tax rate will be reduced to 30%. Further, in 2024-25 the entire 37% tax bracket will be abolished. As a result of these proposed changes, the government states that by 2024-25 around 94% of Australian taxpayers are projected to face a marginal tax rate of 30% or less.

Medicare levy low-income threshold increased

The Medicare levy low-income thresholds for singles and families, as well as seniors and pensioners, has been increased from the 2018-19 income year as follows:

- for singles, the threshold will be increased from $21,980 to $22,39

- for families, the threshold will be increased from $37,089 to $37,794

- for single seniors and pensioners, the threshold will be increased from $34,758 to $35,418

- the family threshold for seniors and pensioners will be increased from $48,385 to $49,304.

Note also that for each dependent child or student, the family income thresholds increase by a further $3,471, instead of the previous amount of $3,406.

BUSINESS

Instant asset write off increased and expanded

The instant asset write-off threshold will be increased from $25,000 to $30,000 from Budget night to 30 June 2020. The threshold applies on a per asset basis. As a result, eligible businesses can instantly write off multiple assets costing less than $30,000 that are first used, or installed ready for use.

The instant asset write off will also be expanded to apply to both “small businesses” (those with an aggregated annual turnover of less than $10 million) and medium sized businesses (an aggregated annual turnover of $10 million or more, but less than $50 million).

Continuation of pooling arrangements for other assets

Small businesses can continue to place assets which cannot be immediately deducted into the small business simplified depreciation pool and depreciate those assets at 15% in the first income year and 30% each income year thereafter.

The pool balance can also be immediately deducted if it is less than the applicable instant asset write-off threshold at the end of the income year (including existing pools). The current “lock out” laws for the simplified depreciation rules (these prevent small businesses from re-entering the simplified depreciation regime for five years if they opt out) will continue to be suspended until 30 June 2020.

Medium sized businesses do not have access to the small business pooling rules and will instead continue to depreciate assets costing $30,000 or more (which cannot be immediately deducted) in accordance with the existing depreciating asset provisions of the tax law.

Small businesses will still be able to immediately deduct purchases of eligible assets costing less than $25,000 that are first used or installed ready for use over the period from 29 January 2019 until Budget night (under the increase in the instant asset write-off threshold from $20,000 to $25,000 announced on 29 January 2019).

ABN obligations and the black economy

The government will make changes to the Australian Business Number (ABN) system to “disrupt black economy” behaviour by requiring ABN holders:

• from 1 July 2021, with an income tax return obligation, to lodge their income tax return; and

• from 1 July 2022, to confirm the accuracy of their details on the Australian Business Register annually.

Currently, ABN holders are able to retain their ABN regardless whether they are meeting their income tax return lodgement obligation or the obligation to update their ABN details.

According to the government, these new conditions will make ABN holders more accountable for meeting their obligations, while minimising the regulatory impact on businesses doing the right thing. Failure to comply will mean losing registration.

Luxury car tax increased refunds for primary producers and tourism operators

The government will provide relief to farmers and tourism operators by amending the luxury car tax refund arrangements. For vehicles acquired on or after 1 July 2019, eligible primary producers and tourism operators will be able to apply for a refund of any luxury car tax paid, up to a maximum of $10,000. It used to be $3,000.

The eligibility criteria and types of vehicles eligible for the current partial refund will remain unchanged under the new refund arrangements.

Delayed amendments to Division 7A

The government will defer the start date of the 2018-19 budget measure “Clarifying the operation of the Division 7A integrity rule” from 1 July 2019 to 1 July 2020.

The government issued a consultation paper in October 2018 seeking stakeholder views on the proposed implementation approach for the amendments to Div 7A.

Delaying the start date by 12 months will allow additional time to further consult with stakeholders on these issues and to refine the government’s implementation approach, including to ensure appropriate transitional arrangements so taxpayers are not unfairly prejudiced.

SUPERANNUATION

Removal of work test for certain members

The current superannuation work test will be removed for people aged 65 and 66 from 1 July 2020. This will enable an estimated 55,000 individuals to make concessional and non-concessional voluntary superannuation contributions even if they are not working. Under current rules, they can only make voluntary contributions if they meet the work test, which requires that they work a minimum of 40 hours over a 30-day period.

By removing the work test, fund members in this age bracket who are no longer working, only working a few hours per week, or only undertaking volunteer work will, should this proposal be implemented, be able to contribute to superannuation and enjoy the concessional tax treatment that it provides.

Extending eligibility for bring-forward cap

Access to the bring-forward cap will be extended from 2020-21 for taxpayers aged less than 65 years of age to those aged 65 and 66. This will enable these taxpayers to make up to three years’ worth of non-concessional contributions, capped at $100,000 a year, to superannuation in a single year.

This will give older pre-retirees greater flexibility to save for retirement. Those in this age bracket will be able to contribute large lump sums that they have on hand into superannuation more quickly; bringing forward the accompanying tax concessions, rather than $100,000 per year under the current rules that apply.

Increase to age limit for spouse contributions

The age limit for spouse superannuation contributions will be increased from 69 to 75 years, from 2020-21. This provides pre-retirees with a greater ability to contribute on behalf of their spouse.

Making spouse contributions is particularly useful where for instance:

• the contributing spouse has already reached their own $1.6 million total superannuation balance restriction

• where the recipient spouse is significantly older, as they can access a tax-free superannuation income stream whereas the younger spouse may not have yet met a condition of release, or

• the contributing spouse is eligible to claim a spouse tax offset of up to $540 as their spouse is a low-income earner.

Reducing red tape for super funds

Superannuation funds that have both an accumulation and retirement interests during an income year can choose their preferred method of calculating exempt current pension income (ECPI) from 1 July 2020.

There is also a proposal to remove a redundant requirement for superannuation funds that are 100% in pension phase for all of the income year to acquire an actuarial certificate when calculating ECPI using the proportionate method.

The ability to choose between the segregated method or proportionate method to work out ECPI will simplify superannuation reporting for SMSFs. Removing the requirement to obtain an actuarial certificate should reduce SMSF costs.

Tax relief for merging super funds

The current tax relief for merging superannuation funds, which is due to expire on 1 July 2020, will be made permanent from that time. Superannuation funds will be able to continue to transfer revenue and capital losses to a new merged fund, and to defer taxation consequences on gains and losses from revenue and capital assets.

This will continue to encourage superannuation funds that are contemplating merging (including SMSFs). There should be no adverse consequences of mergers moving forward. Merging can reduce costs, manage risks and increase scale, leading to improved retirement outcomes for members.

Super insurance opt-in rule delayed

The government confirmed that it will delay the start date from 1 July 2019 to 1 October 2019 for ensuring insurance within superannuation is only offered on an opt-in basis in respect of members with accounts with balances of less than $6,000 and new accounts belonging to members under age 25.

The changes seek to prevent the erosion of super savings through inappropriate insurance premiums and duplicate cover. Affected members can still obtain insurance cover within their superannuation by electing to do so (that is, opting-in).